Safety in your hands

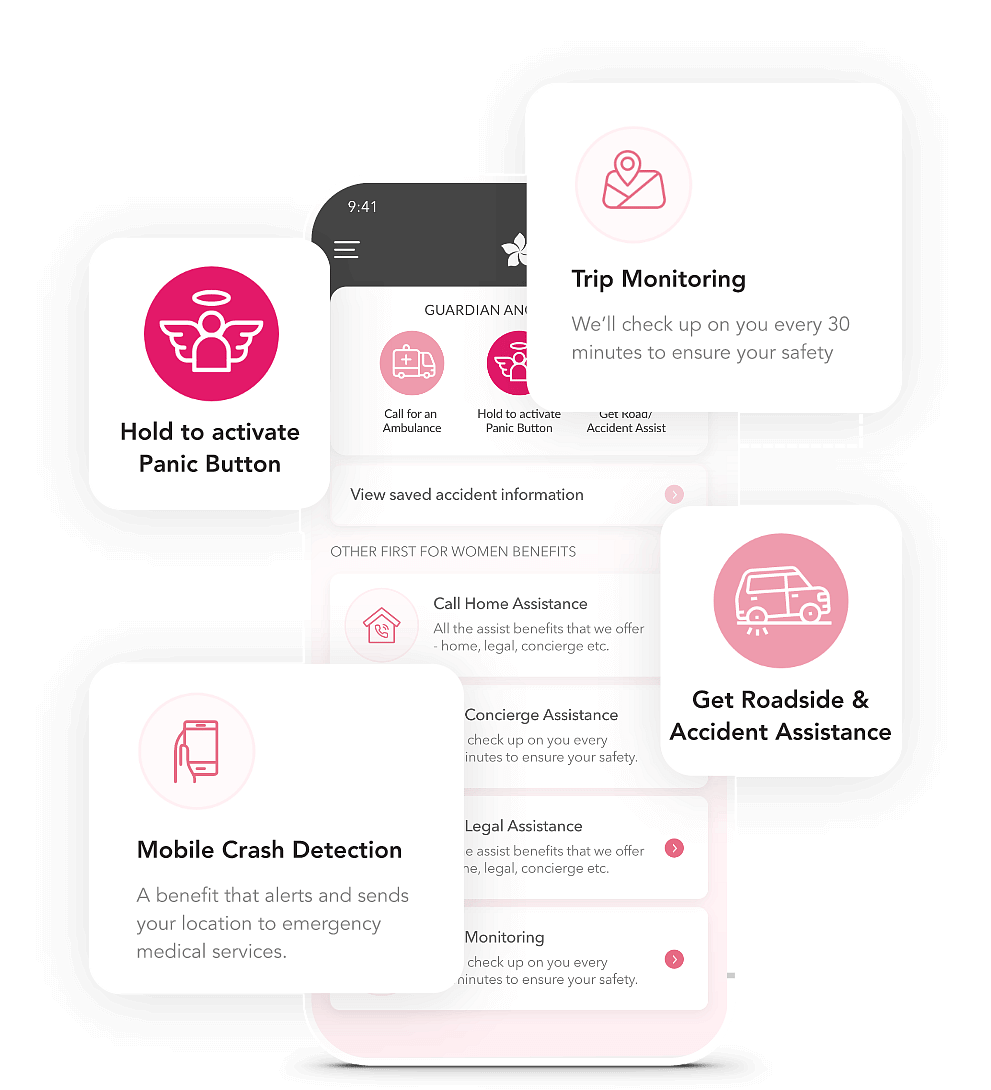

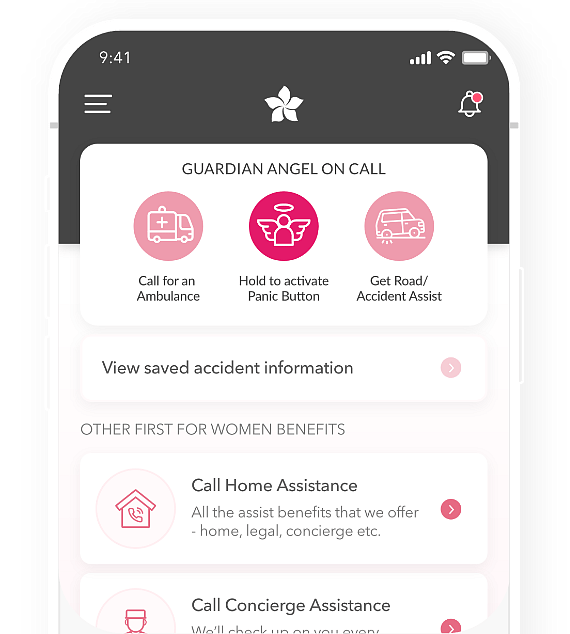

Our intuitive app gives you access to all these safety benefits and more:

Trip monitoring to get you home safely

An unlimited panic button

24/7 Accident and Roadside Assistance

Mobile crash detection

A Guardian Angel to wait with you if you feel unsafe

We’re proud to be rated an excellent 9.2*/10 for service excellence.

*Based on customer feedback from internal surveys following service interactions.

Insurance for every part of your life

Take a look at all the products 1st for Women offer, each designed to give you peace of mind.

Car Insurance

Your car keeps you safe on the road. Keep it safe with our Car Insurance, which includes Guardian Angel on Call.

Find out moreHome Contents Insurance

Your home is filled with the things you love. Keep them safe with our Home Contents Insurance, which includes R25 000 handbag cover.

Find out moreBuildings Insurance

Your home is your haven. And you want to protect it. Keep it safe, from roof to floor, with our Buildings Insurance.

Find out moreValue Added Products

With everything from Tyre & Rim to Funeral Cover, you can count on our Value Added Products to keep you and your possessions safe.

Find out moreBusiness Insurance

Your business is your baby. Keep it safe with our Business Insurance, which includes a range of cover tailored to your specific needs.

Find out moreLife Insurance

A safety net for your family if you pass away. We’ll take care of the finances, so your family can take care of each other.

Find out moreCar Insurance

Your car keeps you safe on the road. Keep it safe with our Car Insurance, which includes Guardian Angel on Call.

Find out moreHome Contents Insurance

Your home is filled with the things you love. Keep them safe with our Home Contents Insurance, which includes R25 000 handbag cover.

Find out moreBuildings Insurance

Your home is your haven. And you want to protect it. Keep it safe, from roof to floor, with our Buildings Insurance.

Find out moreValue Added Products

With everything from Tyre & Rim to Funeral Cover, you can count on our Value Added Products to keep you and your possessions safe.

Find out moreSafety and service at your fingertips

Manage your policy any time, on our app:

Add cover

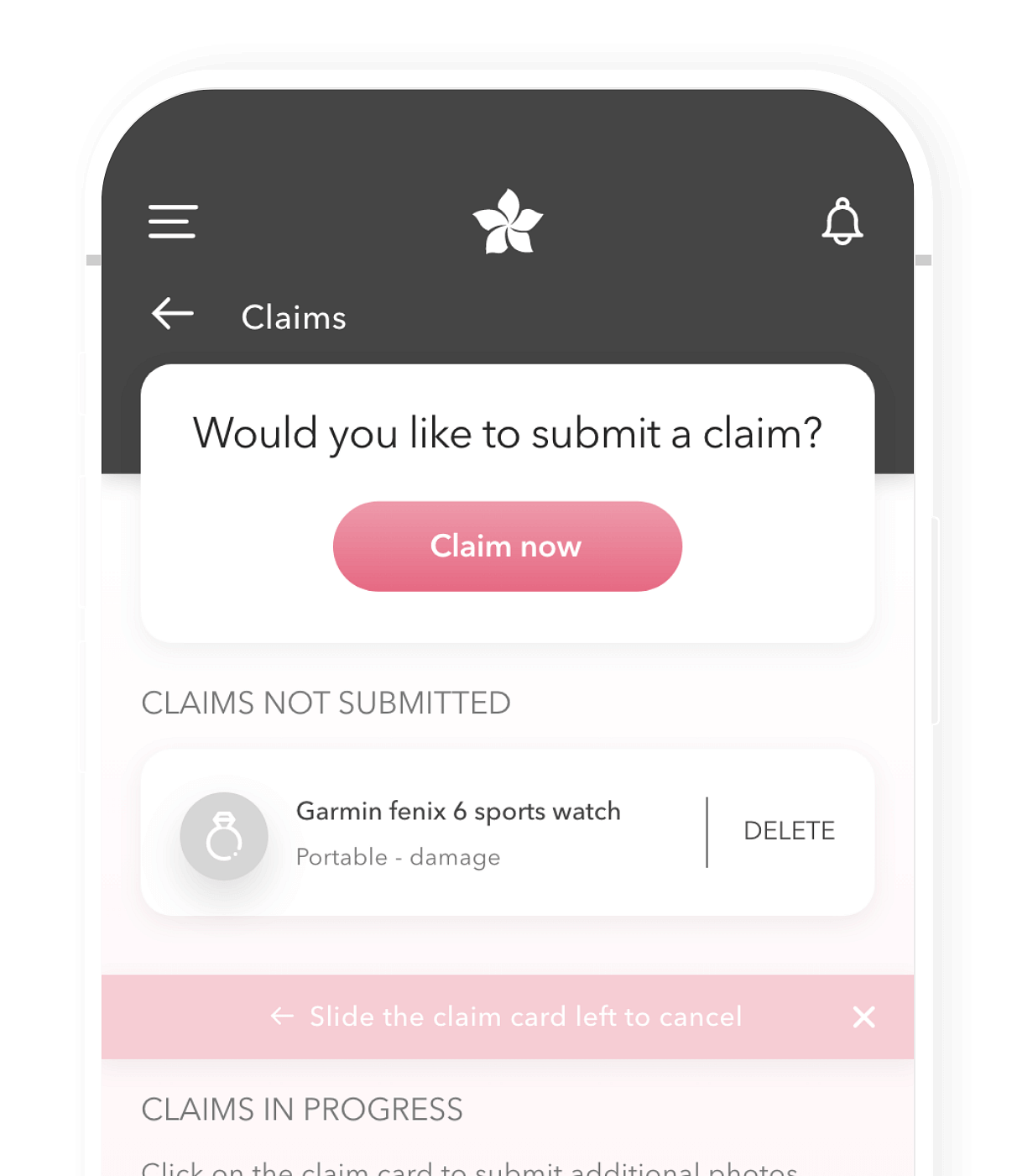

Make a car or home insurance claim

View and edit your policy details

Change or upgrade your cover

At 1st for Women, we think about safety as much as you do. Read our latest blogs.